Cryptocurrencies have been coming under increased scrutiny over recent months from the Securities Exchange Commission (SEC) on the question of whether they constitute a security that would fall under the agency’s jurisdiction. The SEC applies the Howey Test which determines if an investment contract exists by applying the following four principles:

- Is there an investment of money?

- Is there a common enterprise behind the project?

- Is there an expectation of profit? and,

- Is it derived from the efforts of others?

It is argued by the SEC that because most cryptocurrency projects fulfill these criteria, they are subject to securities laws and stricter regulation than is currently applied.

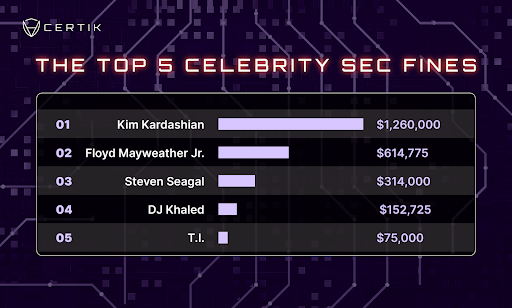

We believe this to be the reasoning behind the SEC Chairman Gary Gensler’s announcement on Ocotber 3, 2022 that Kim Kardashian was being charged for failing to disclose that she was paid $250k for her promotion of a token named EthereumMax. To settle the case, Kim Kardashian will pay a $1.26m fine to the SEC. And it’s not just Kardashian that is in trouble with the SEC, NBA star Paul Pierce and boxer Floyd Mayweather have also been named in the suit. Mayweather has fought back, asking a federal court in California to throw out claims he made misleading and false statements while promoting the project.

These are not isolated incidents. There are plenty of other cases of celebrities endorsing cryptocurrencies, including, Rob Gronkowski’s promotion of Beyond Protocol and Lindsay Lohan’s tweet that she was “Exploring #DeFi and already liking $JST, $SUN on $TRX”. YouTuber Logan Paul endorsed a token named Dink Doink and failed to disclose that he was a key member of the project. Because of the increased regulatory scrutiny that cryptocurrencies are now subject to, it is likely we will see more examples of high-profile personalities facing the consequences of not disclosing the compensation that motivated their endorsements of cryptocurrencies. The next target for the SEC will likely be those personalities that endorsed NFT projects without disclosing their involvement.

Furthermore, there are several ongoing class action suits against celebrities promoting crypto tokens while hiding their ties to the project, most famously against Elon Musk for his endorsement of Dogecoin, and Mark Cuban for promoting Voyager crypto products. In January 2022, a class action lawsuit was filed against Kim Kardashian, Floyd Mayweather, and other celebrities for promoting a dubious cryptocurrency-investment opportunity on their social media platforms.

The lawsuit claims that plaintiff Ryan Huegerich, a New York resident, and other investors who purchased EthereumMax tokens between May 14, 2021, and June 17, 2021, suffered financial losses as a result of the celebrities’ endorsements. EthereumMax lost around 97% of its value since early June, leading some investors to label it as a “pump and dump” scheme where scammers attempt to boost the price of an asset through false or misleading statements. The accusation features in Huegerich’s lawsuit, which accuses Kardashian and Mayweather of “shilling” EthereumMax. The lawsuit claims that EthereumMax “has no connection” to Ether, the second-largest cryptocurrency by market capitalization, adding that its branding appears to be an effort to mislead investors into believing the token is part of the Ethereum network.

Floyd Mayweather and musician DJ Khaled have previously been fined for unlawfully endorsing crypto tokens. The two have agreed to pay a combined $767,500 in fines and penalties to the SEC. According to the SEC, Mayweather and Khaled failed to disclose payments from three initial coin offerings (ICOs), in which new currencies are sold to investors. Mayweather agreed not to promote any securities, digital or otherwise, for three years, and Khaled agreed to a similar ban for two years.

NFT Endorsements

Before the early-2022 crash of the crypto market, it seemed that every few days a new celebrity was promoting their involvement with the world of non-fungible tokens (NFT), cryptocurrencies, or the metaverse. Countless stars, athletes, artists, and even sports teams promoted crypto or NFT partnerships on their social media platforms. This behavior drew increased regulatory scrutiny of the legality of such promotions. According to the SEC, celebrities and influencers using social media to encourage their followers to purchase stocks or other investments could be unlawful if they do not disclose the nature, source, and amount of any compensation paid, directly or indirectly. When a celebrity buys into an NFT collection and then posts about it on their social media platforms, they influence the value of the entire NFT collection due to their public exposure. When investors are relying on the efforts of a celebrity to promote the project and increase its price, they’re getting dangerously close to fulfilling the fourth requirement of the Howey Test. Even if the promoter paid for the NFT upfront, they’re essentially pumping the value of their own investment.

TINA.org – an acronym which stands for Truth IN Advertising – is one of the few watchdog groups that warns celebrities on their potentially unlawful sponsorship of certain NFTs that could violate the Federal Trade Commission (FTC) rules regarding the Use of Endorsements and Testimonials in Advertising and the requirements for influencers. The advocacy group takes it upon themselves to warn celebrities before the FTC potentially steps in regarding NFT promotions. 17 celebrities have been warned by watchdog groups for their shilling of NFTs, including DJ Khaled, Drake Bell, Eminem, Eva Longoria, Floyd Mayweather, Gwyneth Paltrow, Jimmy Fallon, Logan Paul, Madonna, Meek Mill, Neymar Júnior, Paris Hilton, Shaquille O’Neal, Snoop Dogg, Timbaland, Tom Brady, and Von Miller. In this analysis, we will look at several different cases where celebrities endorsed NFTs, examine the regulations around this behavior, and look at the steps that the government has taken to prevent non-transparent promotion of NFTs by public figures.

“Shilling'' is a term commonly used in the cryptocurrency and NFT space. A “shill” is someone who is paid to endorse a product. “Shilling” is not illegal per se, however failing to disclose the fact that the promoter has received compensation and thus has a material conflict of interest can get them into hot water. The FTC stipulates that influencers must disclose any material connections to brands they are endorsing, and make the disclosures clear, unambiguous, conspicuous and within the endorsement. Moreover, the endorsement must mention the “risks associated with investing in such speculative digital assets, the financial harm that can result from such investments and the personal benefit(s) the promoter may gain by virtue of the promotion(s).” Government agencies have published guidelines for influencers in plain, non-legalistic language and have generally taken an educational approach rather than aggressively pursuing legal action.

Overall, it remains unclear how the US government plans to regulate NFTs — but in the meantime, watchdog groups continue to alert celebrities and the community on potential unlawful behaviors. TINA.org sent letters to Justin Bieber’s and Reese Witherspoon’s legal teams notifying them that they each deceptively promoted NFT projects, inBetweeners and World of Women, respectively, on their social media accounts without disclosing that they have a material connection to the companies or that the posts are advertisements. This problem is not isolated to American celebrities. Indian actors and influencers have also been called out for dishonestly promoting crypto projects. Amitabh Bachchan last year revealed plans to monetize autographed posters of his movies, and Salman Khan gushed to his Twitter followers about a mysterious NFT launch.

Taking a closer look at the celebrities warned by the FTC, four individuals stand out for the sheer amount of projects they have been – or continue to be – involved with: Paris Hilton, Drake Bell, Snoop Dogg, and Eva Longoria. Self-proclaimed “Crypto Queen”

Paris Hilton has been involved with over 15 separate NFT projects. Based on her Twitter account, she first entered the NFT scene in early 2021. She began by releasing her first NFT which was auctioned off on Origin Protocol. She would continue this trend by collaborating with Cryptograph, a celebrity NFT project whose proceeds went to charity. She has gone on to develop, collaborate, and promote many other NFT projects continuously since March 2021. Hilton is active in the scene further by participating in interviews, podcasts, and conferences which helps her expand her brand further. Notable projects which Paris Hilton has affiliated with are:

- You by BFF

- Super Plastic

- Origin Protocol

- Particle Collection

- 1,989 Sisters

- Friends With You

- Bored Ape Yacht Club

- E4C: Rangers by Ambrus Studio

- JPierce

- Goldweard

- Blake Kathryn & Paris Hilton

- ThankYouX

- TECHNOFISH

- Nifty Gateway

- Spacedrip by RTFKT

- EY3K0N

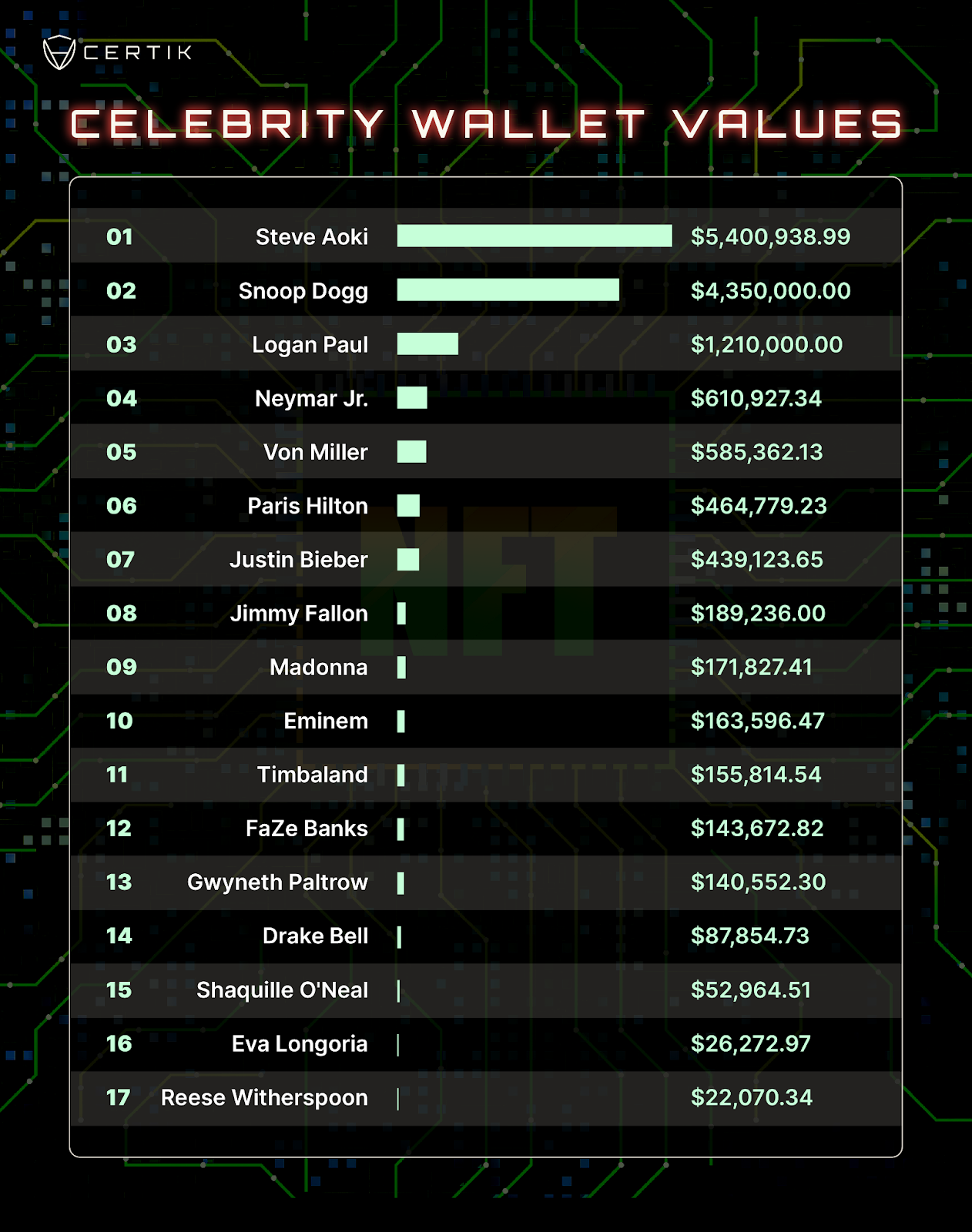

Hilton’s 11:11 Media company revealed that she has made over $3.5m in revenue from NFTs so far in 2022. Furthermore, based on our analysis of her public wallet, she currently holds roughly ~$568,000 worth of assets in both NFTs and ERC-20 tokens.

Similarly to Paris Hilton, Drake Bell first began his foray into NFTs in early 2021, except instead of auctioning charity NFTs he immediately began announcing his NFT purchases and promoting various collections. Beginning in March 2021, Drake Bell has so far endorsed over 20 projects on his Twitter account.

The list of projects Bell has tweeted about includes:

- Bored Ape Yacht Club

- AstroHedz

- CryptoPunks

- Desperate ApeWives

- Happy Hippos

- Numb Bunny

- Crypto Reapers

- Cool Cats

- BearXLabs

- Sol Team Six

- Chibis By NFG Guild

- Ape Trader NFT

- OnePunchFloki

- Hooded Thieves

- Cheems Inu

- GZLR on InuYasha

- Mouse Gang

- Atopia Apes

- Metamonz

It is unknown how much Bell gets paid for each project he tweets about – which is exactly the problem. However, his personal wallet address is public and holds approximately ~$602,000 based on current estimations.

Snoop Doog has an extensive and broad background in NFTs. He announced his first NFT project in April 2021 with the release of A Journey with the Dogg on Crypto.com NFT’s platform. From there, Snoop Doog went on to collaborate and endorse major NFT projects. Snoop Dogg has further supported projects he is involved with by participating in podcasts, interviews, and music collaboration.

The list of projects which Snoop Dogg has tweeted about includes:

- Food Fighters Universe

- Orange Comet

- Solana/Babolex

- Astrals

- The Sandbox Game

- Go Gala Music

Again, it is unclear how much Snoop Dogg has made from his tweeting about his affiliated NFT projects. According to Snoop Doog’s personal wallet, his NFT portfolio has an estimated value of approximately $4.3m.

Eva Longoria first expressed interest in the NFT space in early 2022 and purchased her first NFT from the World of Women project in January 2022. From there she went on to be an active participant in the NFT space, often tweeting in support for current projects she had invested in. Longoria primarily invested in women-led NFT projects. She went on to work with World of Women through and Women Tribe through podcasts, interviews, and charity collaboration.

Eva Longoria is affiliated with:

- World of Women

- Boss Beauties

- FlowerGirls

- 1,989 Sisters

- Women Tribe

- Robotos

- Long Neckie Ladies

- Autograph

Longoria’s NFT portfolio has an estimated value of approximately $26,000.

While information detailing the compensation influencers receive for promoting projects is largely unavailable, there are some public data points. Crypto-Twitter sleuth ZachXBT reported that Lindsay Lohan was paid $25,000 for just one promotional tweet.

CertiK analysts have compiled an extensive list of the most notable celebrities that have been warned by the FTC or otherwise involved in "shilling." It includes all projects which these influencers have endorsed. Please contact us for more detailed information.

Which Projects Are Being Endorsed?

The most commonly endorsed project across all of these celebrities is Bored Ape Yacht Club (BAYC), which has been promoted by nine celebrities including: Paris Hilton, Drake Bell, Eminem, Gwyneth Paltrow, Jimmy Fallon, Logan Paul, Neymar Júnior, Timbaland, and Von Miller. BAYC was launched in April 2021 and is a Yuga Labs’ Ethereum-based NFT project which has yielded more than $2bn in secondary trading volume across three collections. In 2021, Sotheby’s sold two lots of 107 BAYC and 101 Bored Ape Kennel Club (BAKC) NFTs for over $24m and over $1.8m, respectively.

Our analysis shows that Drake Bell has endorsed the most scam projects of any celebrity, with three projects promoted by him either rug pulling or being abandoned. Influencer endorsements of NFTs have dropped sharply alongside the market downturn that began early in 2022. The New York Times reported on the sudden drop-off of celebrities who were vocal about crypto and NFTs when prices were high who have now quieted down about the projects they promoted. These celebrities cannot be held directly responsible for the crash, but marketing experts say they helped add mainstream legitimacy to a fast-growing but poorly understood industry. Celebrities who have seemed to drop off the NFT train (at least on Twitter) include: Madonna, Kim Kardashian, Reese Witherspoon, Tony Hawk, DJ Khaled (who recently deleted all his NFT tweets), Jimmy Fallon, and Meek Mill (his last NFT tweet was in July). Out of these celebrities it appears that Tony Hawk is the only one who hasn’t been contacted by the watchgroup TINA.org.

As discussed above, Kim Kardashian was warned and subsequently fined by the SEC for shilling the project EthereumMax, which would go on to be rugpulled. Kim Kardashian failed to disclose that she was paid $250,000 for the promotional content she produced for EthereumMax. As a result the SEC fined the reality TV star for $1.26 million and Kardashian further agreed to not promote any cryptocurrencies for at least the next three years.

*It is important to note that these are not complete numbers, only estimates based on on-chain data, as these celebrities could have other wallets that are not public. Additionally, the amount paid to them to endorse a project is unknown for the listed celebrities as these may be in other wallets or private transactions, this is known wallet balance at time of writing only. *

In conclusion, celebrity endorsements inflate the value of NFTs by virtue of their own cultural dominance, a form of market manipulation that is currently unrestricted. The SEC and FTC have provided some guidelines but a gray zone nevertheless remains. Although several class action lawsuits are underway, there are no precise details about the legal penalties for promoting NFTs or other crypto assets. Despite the fact that no actual legal consequences have been imposed, watch groups such as TINA.org exist that warn celebrities and influencers about the risks involved in promoting crypto and NFT projects, not least of which is the negative publicity that results in the case of regulatory action. The SEC has also warned investors about celebrity-backed ICOs and influencers’ lack of expertise in NFT technology. Doing your own research and due diligence is crucial to avoid investing in scam projects. It is unwise to take financial advice from celebrities, especially those who have no expertise in the industry and are simply being paid to promote certain projects.

CertiK’s team of security experts are always available to conduct smart contract audits and penetration tests. We assist with the tracing of stolen assets and our 24/7 CertiK Skynet monitoring and alerting service gives up-to-the-minute insights that keep you and your community safe.