SkyInsights is the most streamlined, resource-efficient platform for maintaining crypto compliance. By addressing the critical pain points of illicit on-chain activities, sanctions exposure, and the maze of global crypto regulations, SkyInsights gives builders the tools they need to stay firmly on the right side of the law.

1. Exposure to Illicit Activities

Like a numbered Swiss bank account, the pseudonymous nature of blockchain transactions can provide some degree of cover for illicit activities, such as money laundering or the financing of terrorism. Identifying and mitigating these risks is essential for crypto companies to maintain regulatory compliance.

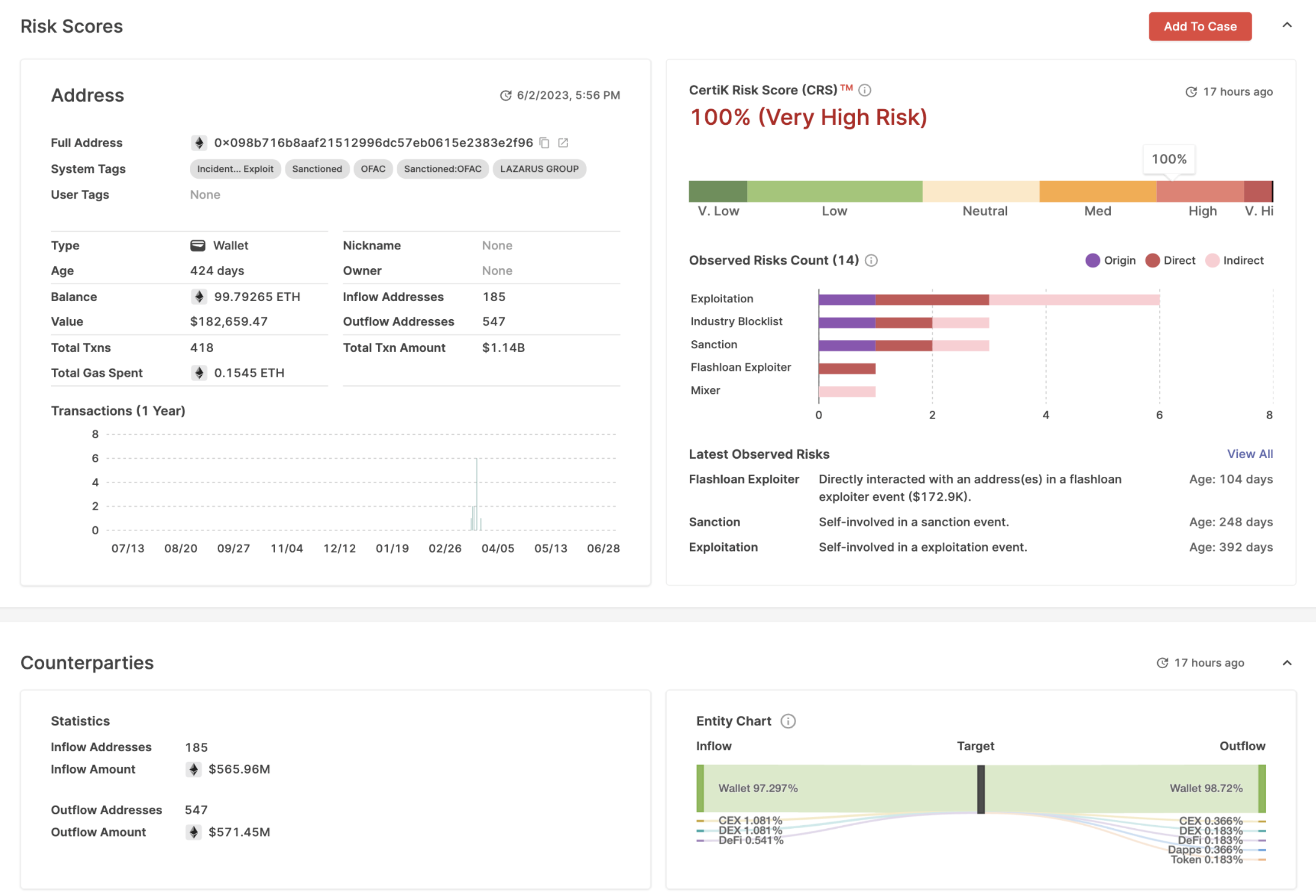

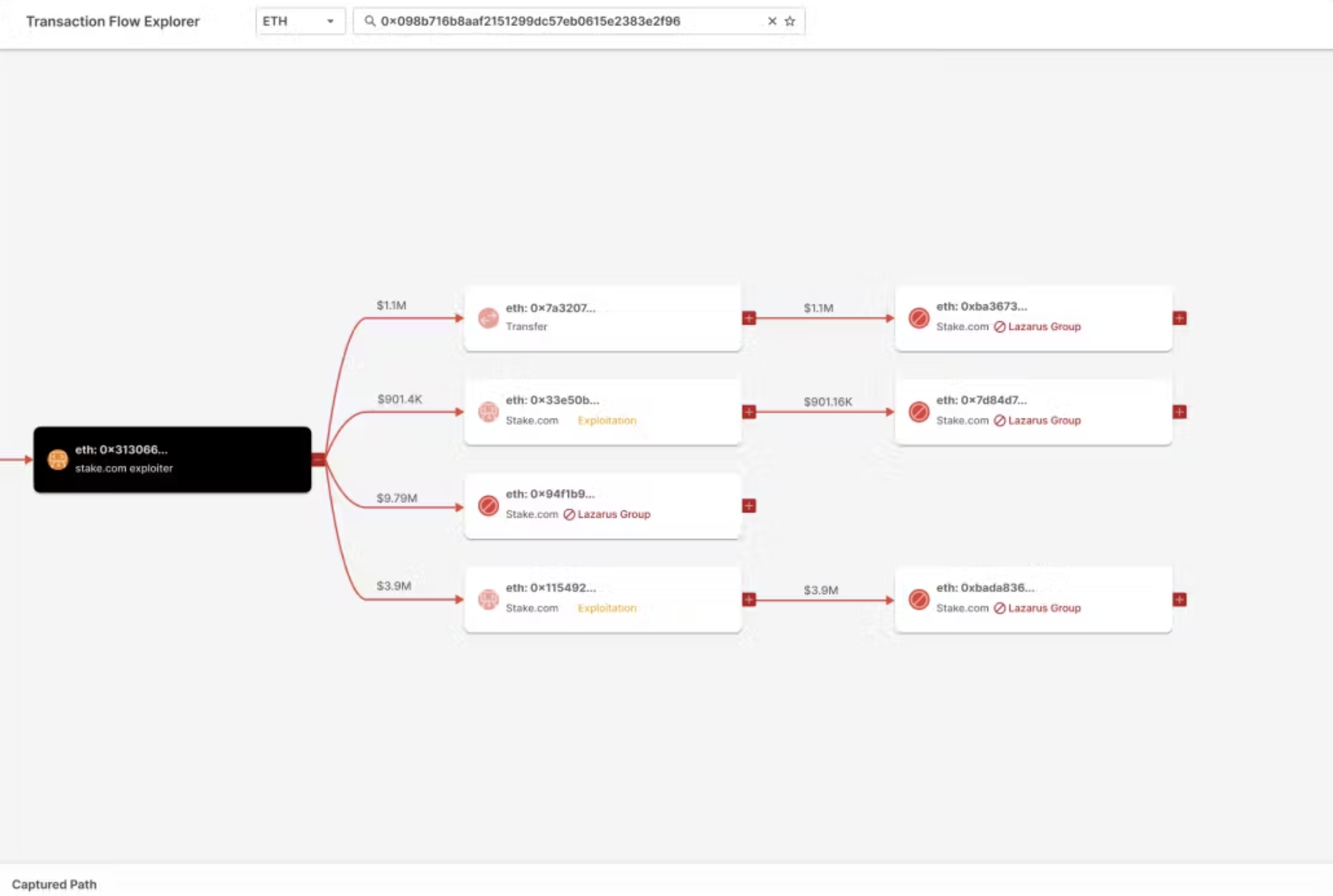

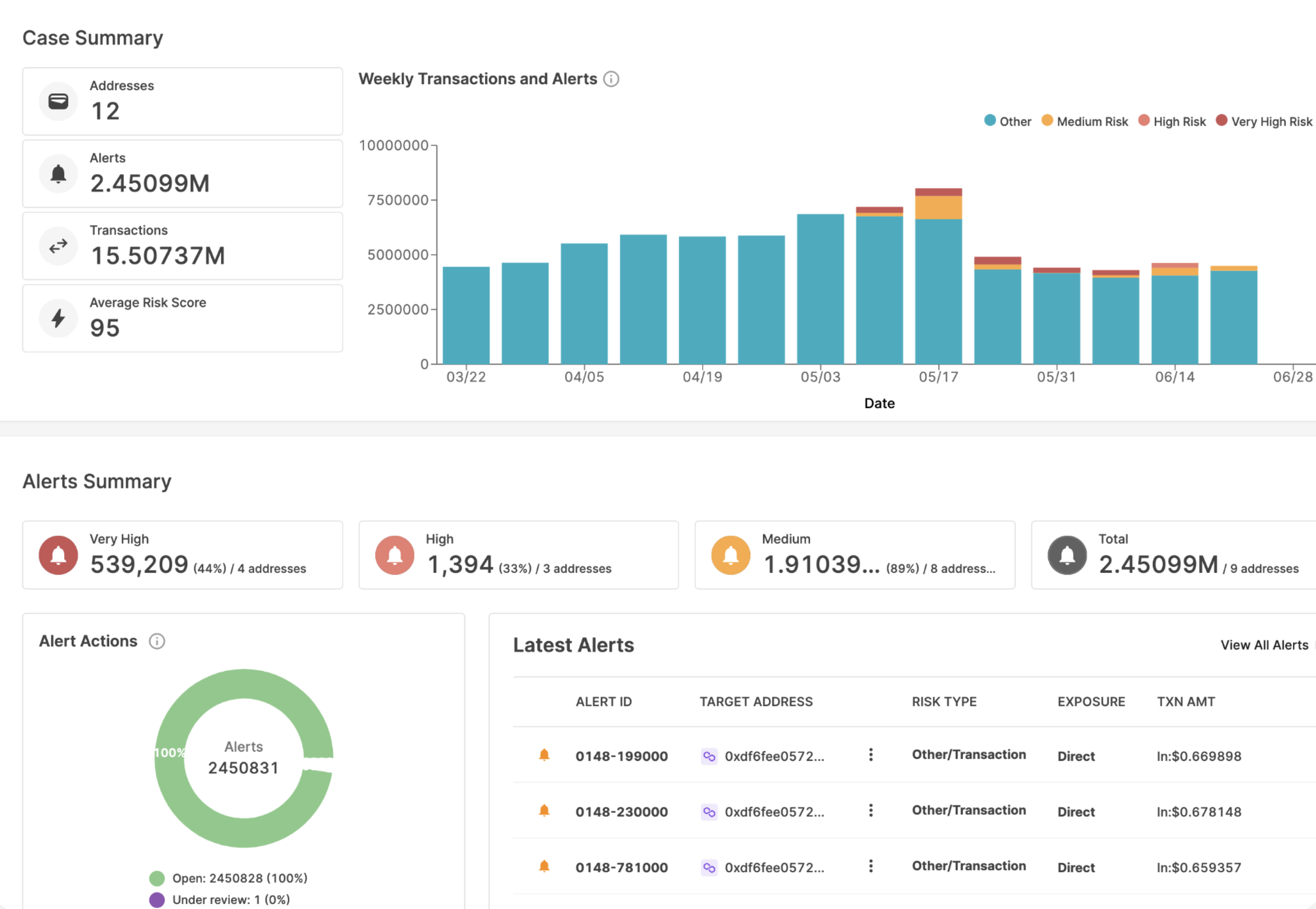

Leveraging state-of-the-art onchain analytics and proprietary databases with billions of labels, SkyInsights' crypto compliance platform gives you the tools you need to monitor and analyze wallets, transactions, and digital assets.

With sophisticated algorithms capable of detecting patterns indicative of illicit activities, embedded security alerts, and real-time risk scoring, SkyInsights enables virtual asset service providers (VASPs) to proactively identify and report suspicious transactions, effectively mitigating the risk of association with illegal or high-risk operations. SkyInsights satisfies your compliance requirements and lets you really get to know your transactions.

2. Sanctions Adherence

VASPs must also navigate the complexities of international sanctions lists. Failure to comply with these sanctions can result in severe legal and financial repercussions, undermining a company's operational viability.

SkyInsights leverages billions of points of onchain data to screen transactions and wallet addresses against global sanctions lists. This ensures that companies with onchain exposure can avoid transactions that may violate sanctions, thereby maintaining compliance and protecting against potential penalties.

3. Jurisdiction-Dependent Regulation

The regulatory landscape for cryptocurrencies began fragmented and is only getting even more so, with different countries implementing varied and sometimes conflicting regulations. This is a significant challenge for Web3 companies operating on a global scale, requiring them to comply with multiple regulatory frameworks simultaneously.

SkyInsights maintains an aggregated, up-to-date repository of global crypto regulations. This database, coupled with advanced analytics, tailored insights, rules-based risk analysis, and easily-implementable compliance strategies, helps Web3 companies better navigate the regulatory complexities of each jurisdiction in which they operate.

SkyInsights is the most streamlined, resource-efficient platform for establishing and maintaining crypto compliance. By addressing the critical pain points of illicit on-chain activities, sanctions exposure, and the maze of global crypto regulations, SkyInsights gives builders the tools they need to stay firmly on the right side of the law.

Get back to building, and let SkyInsights handle the paperwork.